Mortgage calculator extra payment current balance

Current Redmond mortgage rates are published. Which many lenders allow.

Mortgage Repayment Calculator

Mortgage calculator - calculate payments see amortization and compare loans.

. Bi-weekly payments equate to one extra payment each year and 51 fewer months on a 30-year loan. Loan Original Payment With 13th Payment Each Year. Calculate the difference in total interest paid on a mortgage loan when making additional monthly payments.

Adjust down payment interest insurance and more to start budgeting for your new home. The balance of the home loan or mortgage to be paid off. Current approximate balance of your mortgage.

Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment. You can also use the calculator on top to estimate extra payments you make once a year. Calculate your monthly mortgage payment with current.

Results Current Current Plus Extra Bi-Weekly Bi-Weekly plus Extra Mortgage payment. The loan is secured on the borrowers property through a process. Viewing Your Results Once you have filled out all your information click on the calculate button to see the side-by-side results for your old loan and the loan with extra payments made.

You decide to increase your. If you enter your current mortgage balance in the Loan Amount then enter the number of years you have left on your mortgage. Monthly payments start on.

This mortgage calculator is a well-equipped loan calculator that deals with multiple questions arising when you are about to buy a house with a mortgage loanAs the primal function it enables you to estimate your payment with different loan constructions and compare them alongside its connected costs especially its interest payments. Also answers is it better to invest. Since creating this spreadsheet Ive created many other calculators that let you include extra mortgage paymentsThe most advanced and flexible one is my Home Mortgage Calculator.

For your convenience current Redmond mortgage rates are published below. Tips to Shave the Mortgage Balance. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule.

Current mortgage payment less escrow. This free online calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment once a month. The answer to both questions depends on the current balance the loans interest rate when you start making extra payments and the additional payment amount.

30-Year Fixed Mortgage Principal Loan Amount. The FHA went on to set restrictions on interest rates and terms and required fully amortizing loans. Extra Payment Mortgage Calculator.

Extra Payments In The Middle of The Loan Term. The new loan structure and terms would eventually mitigate much of the old mortgages risky payment structure. Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default.

The calculator lets you find out how. Your mortgage payment is defined as your principal and interest payment in this mortgage payoff calculator. Once the equity reaches 20 of the loan the lender does not require PMI.

Starting from the first year of your loan. You could add 360 extra one-type payments or you could do an extra monthly payment of 50 for 25 years and then an extra monthly payment of 100 for 3 years etc. Estimate your monthly payment with our free mortgage calculator and apply today.

For Excel 2003. The amount of time saved on the current loan schedule by making additional payments toward the principal mortgage balance. This is calculated as the home price less the down payment.

A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. Current approximate balance of your. Extra payment calculator with payment schedule calculates interest savings due to one lump sum or multiple extra payments.

To estimate how much time and interest you can save use our extra mortgage payment calculator. Pay this Extra Amount. Then choose one of the three options for enteringcalculating the number of mortgage payments made leave two of the options blank and click the Calculate Mortgage Balance button to return your current balance loan payoff amount.

Use a mortgage refinance calculator to determine the breakeven point which is the number of months it takes for the savings to outweigh the cost of refinancing. Mortgage Monthly Payment Extra 50 Extra 100. The term of the loan and the mortgage interest rate.

Expensive penalty charges can dwarf any savings you make from bi-weekly payments. When you pay extra on your principal balance you reduce the amount of your loan and save money on interest. So if at all possible save up your 20 down payment to eliminate this.

Jan-15-2023 Payment 5 95483 66281 29203 Feb-15-2023 Payment. Years to pay off. Use this additional payment calculator to determine the payment or loan amount for different payment frequencies.

Today the most common payment term is a 30-year fixed-rate mortgage. A mortgage calculator is a smart first step to buying a home because it breaks down a home loan into monthly house payments based on a propertys price current interest rates and other factors. Advantages Disadvantages of Biweekly Payments.

If this is an existing mortgage the extra payment mortgage calculator will assume that a payment has not been made for the current month so the current month will be used as the start of the amortization schedule. It does nothing for you except put a hole in your pocket. You can still boost your mortgage even if you make extra payments after a couple of years on your mortgage.

Make payments weekly biweekly semimonthly monthly bimonthly quarterly or. Enter the mortgage principal annual interest rate APR loan term in years and the monthly payment. Mortgage Amount or current balance.

The CUMIPMT function requires the Analysis. How many years does an extra mortgage payment take off. Equity after 5 years.

Your current principal balance stretches across the. You can also see the savings from prepaying your mortgage using 3 different methods. 360 original 30-year term Interest Rate Annual.

You have a remaining balance of 350000 on your current home on a 30-year fixed rate mortgage. If your current rate on a 30-year fixed loan is 4000 would you like to see. Interest youve already paid.

September 15 2022 Monthly mortgage payments. It is possible to. Equity after 10 years.

If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the. Even a little can go a long way. Extra Mortgage Payment Calculator 47.

The Vertex42 Mortgage Payment Calculator is a very simple spreadsheet that lets you compare different mortgages side-by-side. In effect you will be making one extra mortgage payment per year -- without hardly noticing the additional cash outflow. Since a bi-weekly plan results in 13 annual payments making that extra 13th payment can trigger the penalty.

Mortgage terms were changed to have options longer than 15 years. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. If you make one entire additional mortgage payment per year.

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

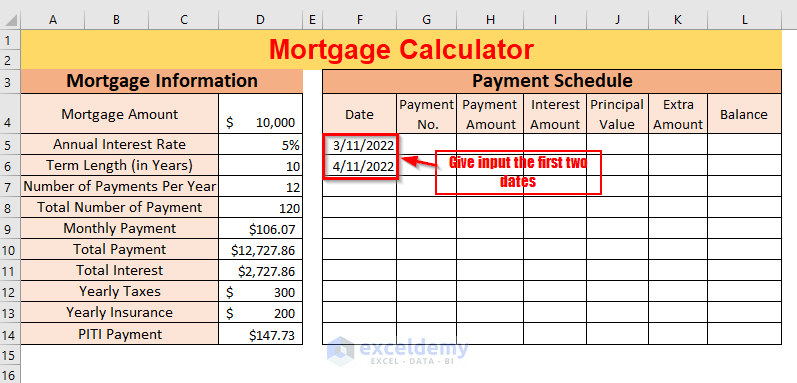

Creation Of A Mortgage Calculator With Taxes And Insurance In Excel

Downloadable Free Mortgage Calculator Tool

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Downloadable Free Mortgage Calculator Tool

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortization Schedule Template With Extra Payments

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Extra Payment Mortgage Calculator For Excel

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Free Interest Only Loan Calculator For Excel

Mortgage With Extra Payments Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Extra Payment Calculator Is It The Right Thing To Do

Extra Payment Calculator Is It The Right Thing To Do

Mortgage Calculator With Extra Payments And Lump Sum Excel Template